The Influence of U.S. Car Markets

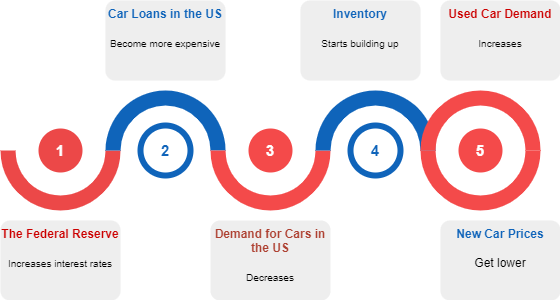

Canada’s financial system is closely tied to that of the United States, making U.S. interest rate policies pivotal. When the Federal Reserve raises rates, car loans in the U.S. become costlier, potentially curbing consumer demand for new and used vehicles. Higher borrowing costs may lead to an inventory surplus, pushing dealers to reduce prices. However, this could also elevate demand for used cars, driving up their prices and contributing to sector inflation.

Canadian Interest Rates

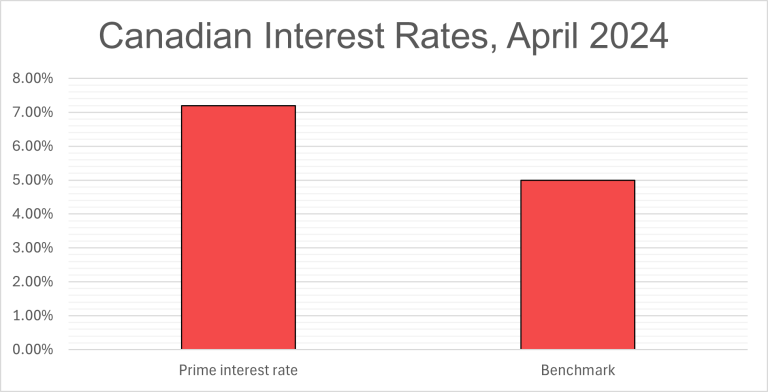

The Bank of Canada’s monetary policies often mirror those of the U.S. to maintain economic stability. If the U.S. were to continue raising interest rates to combat inflation, Canada might follow suit to safeguard the Canadian dollar and manage capital outflows. Such synchronized policies could tighten financial conditions domestically, particularly as rising inflation and interest rates squeeze consumer spending, complicating auto ownership prospects with steeper loan terms.

Impact on U.S. and Canadian Auto Manufacturing

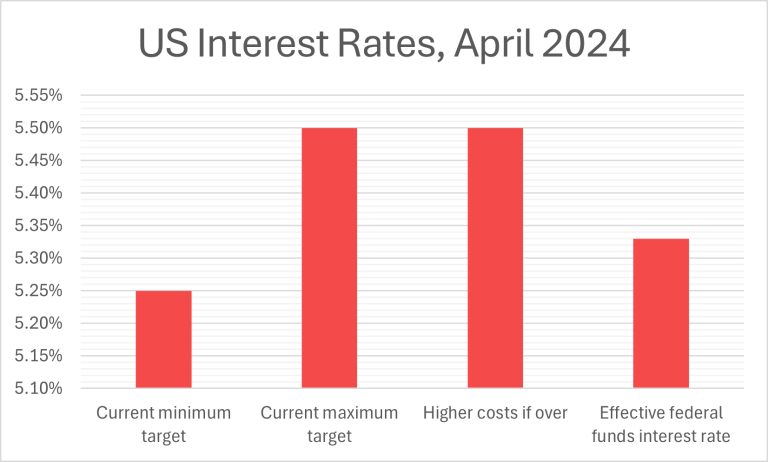

The auto manufacturing industry in the U.S. is highly sensitive to interest rate fluctuations. Higher rates can escalate production costs, which may be transferred to consumers through increased car prices. Should consumer preferences for sustainability endure, elevated costs might depress demand, prompting potential downsizing within the industry.

Japanese Cars and Economic Impacts

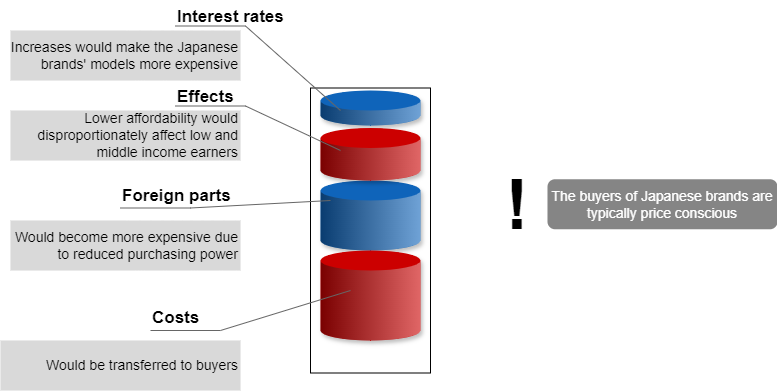

Japanese vehicles, favored for their value, may face rising costs with impending interest rate hikes. The increased expense of foreign-made parts, exacerbated by diminishing purchasing power, could be passed on to consumers. This, coupled with the reduction of affordable options, might dampen Canadian enthusiasm for car ownership.

Shifts in Car Ownership Economics

As Canada transitions towards a service-dominated economy, mobility solutions like ridesharing may gain traction, reducing personal car ownership needs. The concentration of job opportunities in specific areas, coupled with inflation’s impact on young professionals, underscores the growing challenge of car affordability. Extended loan terms for new and used cars, now reaching up to eight years, exacerbate this issue by inflating the overall cost of ownership, particularly if payment schedules are disrupted.

The evolving economic landscape presents significant challenges and opportunities for car ownership in Canada. As interest rates rise and fall, and consumer behaviors shift, the intricate dance between economic forces on both sides of the border will continue to shape the future of auto ownership, demanding keen attention and adaptive strategies from all stakeholders involved.